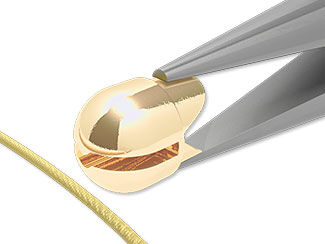

How to Use Bulldog Crimps™

Using Bulldog Crimps™ is easy. They work ideally as temporary crimps for stringing beads and holding multiple strands together for display or organization.